Why Buy an I Bond?

1. want to earn a great interest rate

2. in a safe investing environment

3. and protect some of your cash from eroding in buying power due to inflation?

Then you might want to purchase an I bond from Treasury Direct.

It's disheartening to hear friends of family back off of I bonds because they are just such a strange animal compared to a CD. They are just as easy to buy as a CD on brokerage platforms like Fidelity or Schwab.

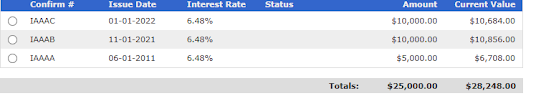

I only suggest you research strategies that I have tried myself. I own three I Bonds. A screenshot of my account is at the bottom of the post.

But First - What is an I Bond?

An I Bond is a savings bond that is designed to help you fight inflation. The rate paid is based on the current inflation environment.

I Bonds are only available for individuals to purchase through Treasury Direct. www.treasurydirect.gov

If it sounds intimidating to open an account with Treasury Direct, please let me reassure you, it is not! Remember when you were a kid and your parents bought savings bonds for you? Those bonds are also sold on Treasury Direct. It's the same organization and designed for all citizens to use.

The hardest (i.e., just plain boring) part about buying your first I Bond will probably be setting up your Treasury Direct account and the funky old keyboard interfact for entering your password. The steps are 1, 2, 3 on the site starting on the main page "Open an Account" button.

Here's the interface for the password. You just click the keys that correspond to your password. Don't let it throw you off! That part of the site is just a bit more antiquated than the rest.

How Are I Bond Interest Rates Set?

I bond interest rates are set every six months, May 1 and November 1. If the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U)> for all items, including food and energy, goes up? So does the I Bond interest rate paid to those who hold a bond.

Why are People Scooping these Up?

1. Nobody likes how hard it is to predict inflation, or how much it cuts into our buying power. I bonds are an easy first step to make sure your money grows with inflation.

2. The purchase is commission free. You can do it from your computer.

a) set up a Treasury Direct account at treasurydirect.gov

b) link your bank account to the TD account so you can transfer funds either way

3. Invest any amount up to $10,000 per person per year.

a) there are ways to invest more, if you have the extra cash. You can tell your CPA to use your tax refund to purchase I bonds. You can also gift an extra $10,000 per person per year to your partner in your household.

4. The I bond will continue to earn interest for up to thirty years.

Downsides to I Bonds

1. You've got to hold the Bond for at least one year. Which can be a good way to make sure that you don't cash it in for a new boat. (Boats are sink holes for money. Do not do it!)

2. If you cash in the I bond after one year, you will lose three months of interest. When interest rates were down around 1% for most fixed instruments and I bonds began paying over 9%? The three months of interest was no biggie.

Once you hold the IBond for five years? No penalty when you cash it in.

That's about it to the downsides. As you see below, I have a little bit of money earning a nice rate at least until May 2023. I can cash out the smaller I bond at any time because it was purchased so long ago.

(Note: Don't be surprised, like I was, if you don't see your I bond's interest growing at the 6.89% rate. The I bonds bought that are still under 5 years old will not show the last three months interest in the current value column. So the interest rate will appear to be "off." But the treasury direct website is just not showing you the last three months of interest, because you might decide to redeem the bond earlier and incur the penalty.)

Questions? Please post them in the comments below. I gotcha' covered!

No comments:

Post a Comment