Interest Rates are Up Again - Time to Lock in Gains!

Once again, the Federal Reserve is upping the interest rate by .75 basis points.* It's a golden time for those wanting secure investments that pay a pretty interest rate and the rates may go even higher according to Fed Reserve Chairman Jerome Powell.

Here is what US Treasuries and CDs are paying at Fidelity.com today, 11/4/2022 at 8:23 a.m up to 5 year maturity. Not only can you purchase these with money in your after-tax brokerage account there, but you can also purchase via your IRAs or 401K.

Real-Life Case Example:

I have an extra $10K that is coming to maturity in my CD ladder. (I bought it as a short-term, 6 month CD of $9,000 back in May of 2022. It has only been accruing .95% interest at the time. Less than 1%).

Now is my chance to lock in a longer, better, very secure rate with a CD or a bond. You can do the same!

CDs offered on this platform at the 2-year mark are paying higher rates than Treasuries. They are also very safe, as they are F.D.I.C. insured. I'm planning to pick up a 5% CD next week for the 2-year short term. It's only a $ 500-a-year return, but I'll take it! If I had more cash to invest, I would.

CD ladders have really helped my F.O.M.O. with current CD and bond rates. I have new money freeing up for investment every few months. Keep in mind this money has only been earning .05 - 1.5% for a while, so it needs a boost!

Are you planning to buy a CD or bond soon and have questions?

Google searches about bond buying today that are most common include these:

- Buying bonds at a discount

- Buying bonds on a premium

- Treasury Direct

I did not receive this book free of charge as a payment to promote! It was my own purchase and I believe it cost only about $6.00. I was so impressed with the ease of understanding baked into the 1 hour or so it took to listen to the book, that I am hot to recommend it.

Here are a few highlights from the book:

Buying bonds (or bills) at a discount

The author, plus info from this Investopedia page about T-bills, gives simple straightforward advice on buying bonds at a discount. Let's use this Treasury bills purchase as an example:

- Let's say you purchase ten Treasury bills for $100 each. They mature in 52 weeks. The T-bill sales info declares a 5% coupon rate or yield to maturity (YTM) rate. Because the bills are sold at a discount, you only pay $950 for all of them. At the end of the 52 weeks, you will receive $1,000 back.

- Your yield is the difference between the T-bill's discounted purchase price and the face value due back to you on the maturity date.

- Test your knowledge -- what if the YTM was only 3%? Did you come up with $970 as your discount rate? It would cost you $970 to buy the bills that would return $1000 52 weeks later

Buying bonds at a premium

Let's use a Treasury Bill as an example. If a Treasury Bill for sale has a face value of $1000 is paying 7% interest and matures in 10 years when new TBills are only paying 3%? You will need to pay a premium to get your hands on the bill.

A simple explanation is available another good reference, this book

"Bond Investing for Dummies" by Richard Wild, MBA. (paid link). "

Don't ask why, but bond people quote the price of a bond on a scale of 100. If a bond is selling at par, or face value, it is typically quoted as selling at 100...If that bond is selling for 105, it's a premium bond, and you need to fork over $1,050."

I didn't get a free copy of this book to include in this blog post, but I do get a small affiliate commission if you click the link and purchase the book on Amazon. If you search your local library, you can probably find a copy, that's where I got mine. It's a good reference book for your personal finance library. I will probably buy a copy when my library loan runs out of time.

A Beginner's Look at Investing in Treasury Bonds

1. Get your Treasury Direct account set up if you don't have it already. It's very simply explained at

treasurydirect.gov

2. Once you have your treasury direct account set up, it's fairly straightforward to use the platform.

First, take note of the menu bar across the top of the first page of your account. (see below image, it begins with "My Account" on left and ends with "Gift Box" on right.

3. Click on "BuyDirect" blue tab to purchase your bonds.

4. Immediately below is the list of products you can buy from that page, starting with "Marketable Securities: Bills - Short-term securities of 1 year or less"

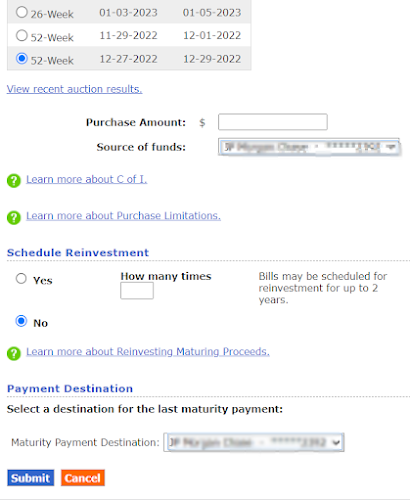

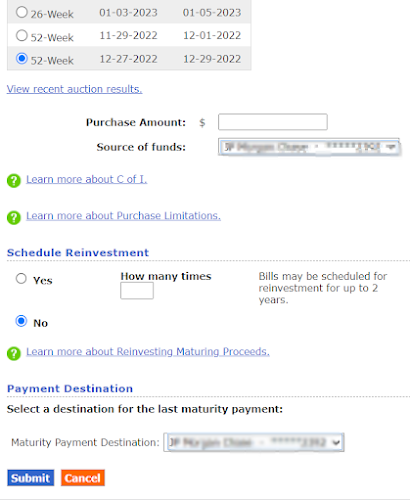

5. I clicked on Bills, just as an example. And this is the screen that appeared.

a. You will see a section of a list...be aware that you can click through to multiple screens. The first screen starts with the button you see below labeled "4-Week." If you wanted to see purchase information for 4-week treasury bills, that's the button you would click into.

Scroll down on this blog page to see a screen shot of the end of the product list.

b. Here's the bottom of the screen showing a 52 week bill purchase.

|

If you click on the "52-week" label and the "view recent auction results" link immediately below, you will see how much interest a 52-week bill is paying.

At the time of this writing, you could buy the 52 week bill for $950.44. That's a 4.505% yield if held to maturity. If you purchased one bill for $950.44, you will receive $1,000 back in 52 weeks, so your gain is about $50.

c. The purchase amount empty box is where you fill in how much you have in cash to use.

d. The source of funds is the bank account attached when you set up the Treasury Direct account.

e. The Schedule Reinvestment section is where you can click "yes" or "no" to scheduling a reinvestment of capital when the bill matures.

f. The Payment Destination section allows you to select where you want your funds returned upon maturity of the bill/bond if you aren't reinvesting the money.

Once you hit "submit" -- you are done! Congratulations. I hope this explanation was helpful.

|

Have you used Treasury Direct to purchase US Treasury securities? Or do you prefer Fidelity, Schwab, or some other brokerage. Would love to hear from you in the comments!

As an Amazon Associate, I earn a commission from qualifying purchases.

.png)

No comments:

Post a Comment